Starbucks (SBUX) is a global coffeehouse giant that started as a coffee bean seller and is now famed for its premium brews, cozy vibe, and iconic green siren logo. It offers espresso drinks, lattes, Frappuccinos, teas, pastries, and snacks, turning coffee into a daily ritual for millions.

Founded in 1971, it is headquartered in Seattle, Washington, with over 38,000 stores under its belt in over 80 countries.

Starbucks Stock Sparks Rally

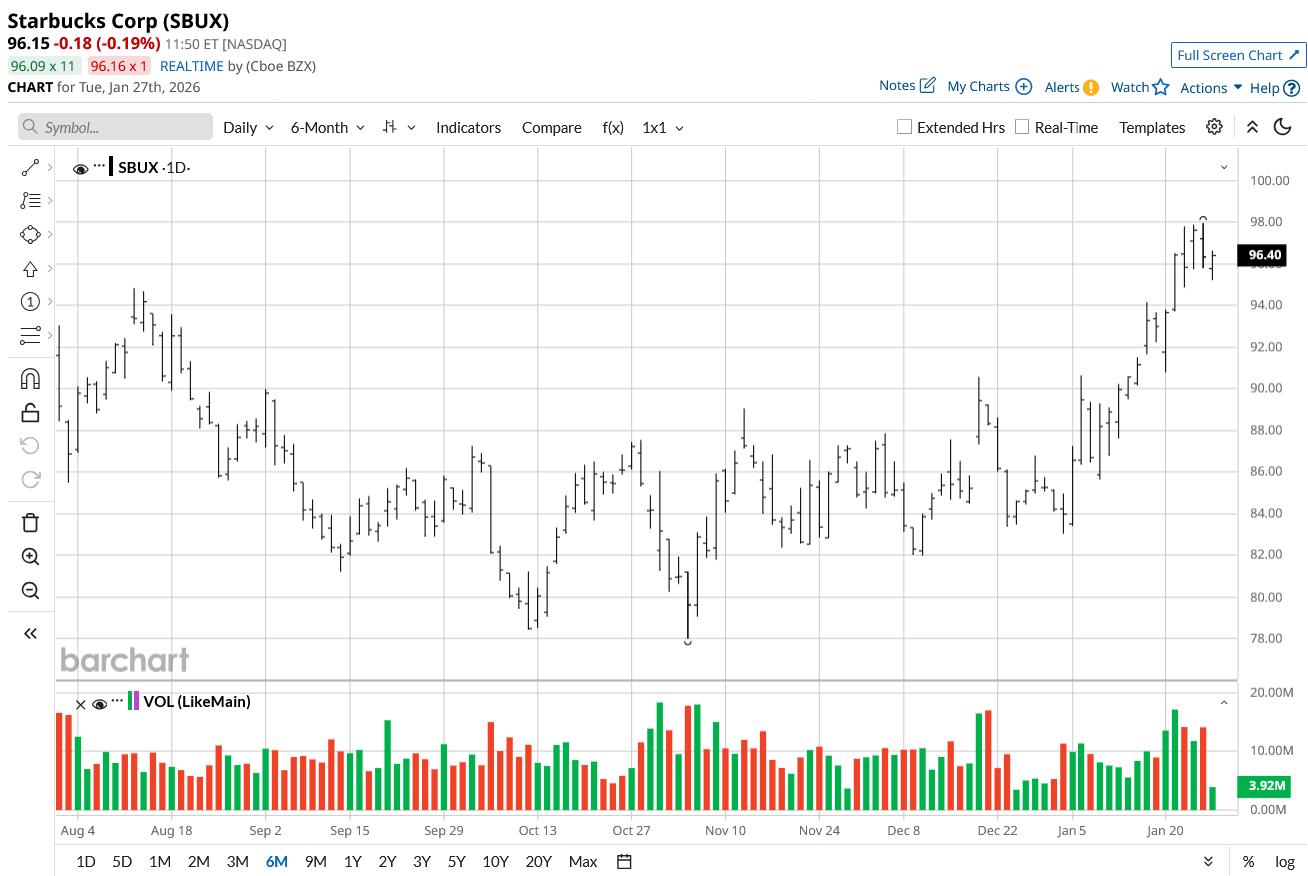

Starbucks' stock has shown strong momentum in early 2026. As of late January, SBUX shares are up 14.5%, with a 3% gain in the last five days and 13% in a month. Despite this, Starbucks struggles from a medium- and long-term viewpoint, with shares gaining just over 2% in six months while being 18% off its 52-week high reached in March last year.

Compared to the S&P 500 Consumer Discretionary Index ($SRCD), Starbucks easily outperforms the index in the short-term time frame, with the index reporting flat in its five-day and one-month performance report, but from a long-term perspective, the S&P ($SPX) has gained 43% in the last two years, compared to SBUX stock's 4% in the same time.

Starbucks' Results Disappoint

Starbucks reported Q4 fiscal 2025 results on Oct. 29, 2025, with net revenues of $9.6 billion, up 5% year-over-year (YoY). GAAP EPS came in at $0.12, missing analyst estimates, which expected around $0.82 for adjusted EPS and $9.33-9.57 billion for revenues, due to restructuring costs and margin pressures.

Operating income dropped sharply to $308.5 million from $1.25 billion last year, with operating margin contracting to 4.5% from 18.7%. Cash reserves stood strong, supporting free cash flow amid store optimizations. Global comparable store sales rose 1% after declines, driven by international growth (3% comps). The company closed 627 stores net, totaling 40,990 locations.

Starbucks provided cautious guidance, targeting modest global comparable sales growth and mid-single-digit store expansions for fiscal 2026. The full-year outlook emphasized turnaround efforts under CEO Niccol, focusing on "Back to Starbucks" initiatives like labor investments and promotions, without precise EPS or revenue targets amid ongoing restructurings.

What to Expect From Q1?

Starbucks is scheduled to release its Q1 2026 results on Jan. 28, with analysts expecting the company to report an EPS of $0.57, reflecting a 17.39% slip from the same quarter last year, but it expects them to bounce back following that with a 4.88% growth to $0.43 per share, ending FY 2026 earning $2.32 per share with 8.92% growth from the previous year.

Further, Starbucks is also set to host a key investor day event on Jan. 29.

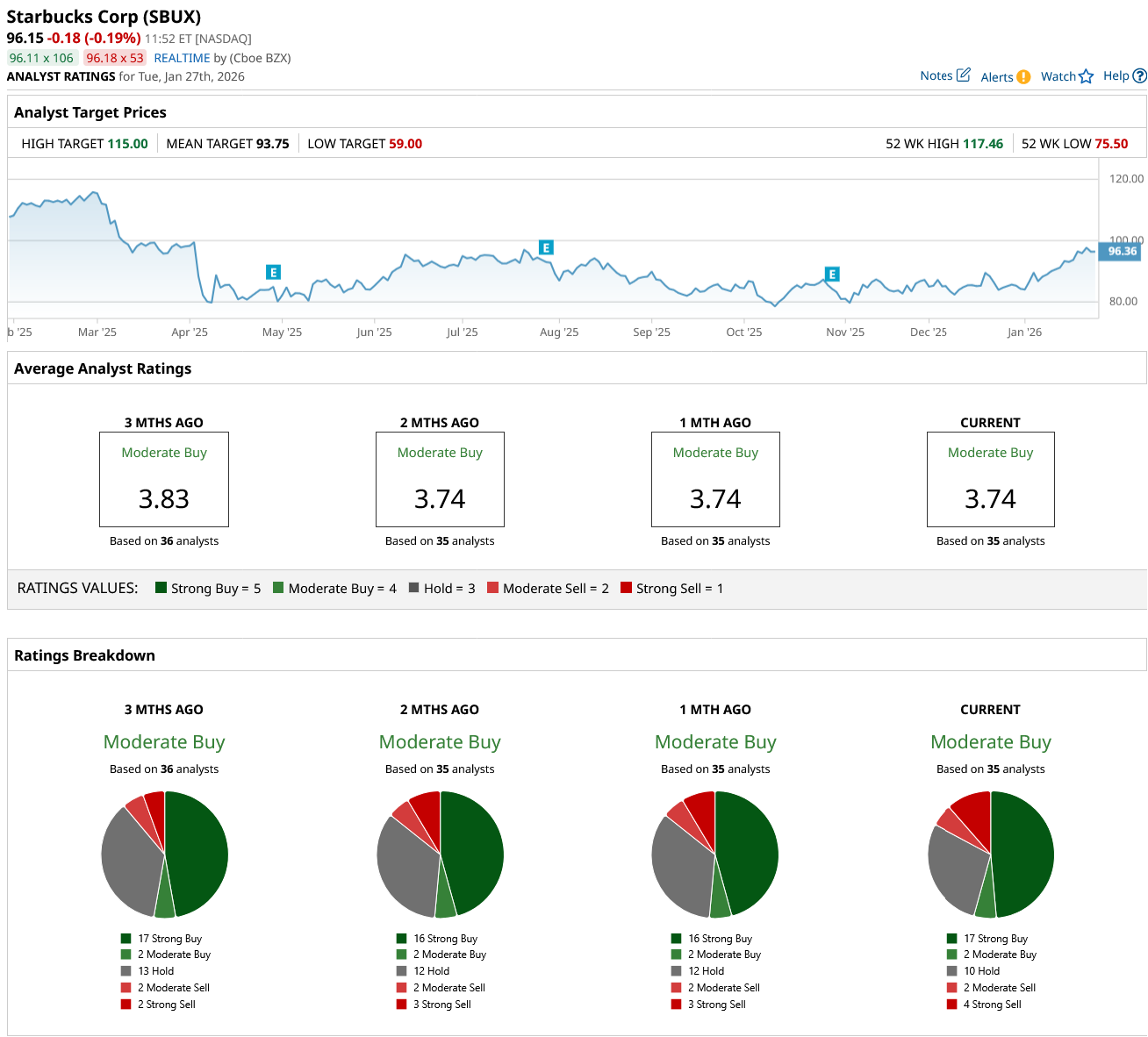

As per the stock movement, analysts have SBUX locked on a consensus “Moderate Buy” rating with a mean price target of $93.75, reflecting a slight downside of 2.5% from the market rate.

The stock has been rated by 35 analysts, receiving 17 “Strong Buy” ratings, two “Moderate Buy” ratings, 10 “Hold” ratings, two “Moderate Buy” ratings, and four “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart