Tesla (TSLA) is set to release its Q4 2025 earnings on Wednesday, Jan. 29. The stock is trading down 3% for the year heading into the confessional, and this year's price action has been relatively muted by Tesla standards. Let's analyze Tesla’s Q4 earnings estimates and examine whether the stock is a buy or a sell ahead of the report.

Tesla Q4 Earnings Estimates

Consensus estimates call for Tesla’s Q4 revenues to fall 3.7% year-over-year (YoY) to $24.75 billion. I believe the estimates are still quite optimistic as the company’s deliveries plunged 16% YoY in the quarter. While the Energy segment could be a savior, it might not be able to fill in the void created by the decline in the company’s automotive business.

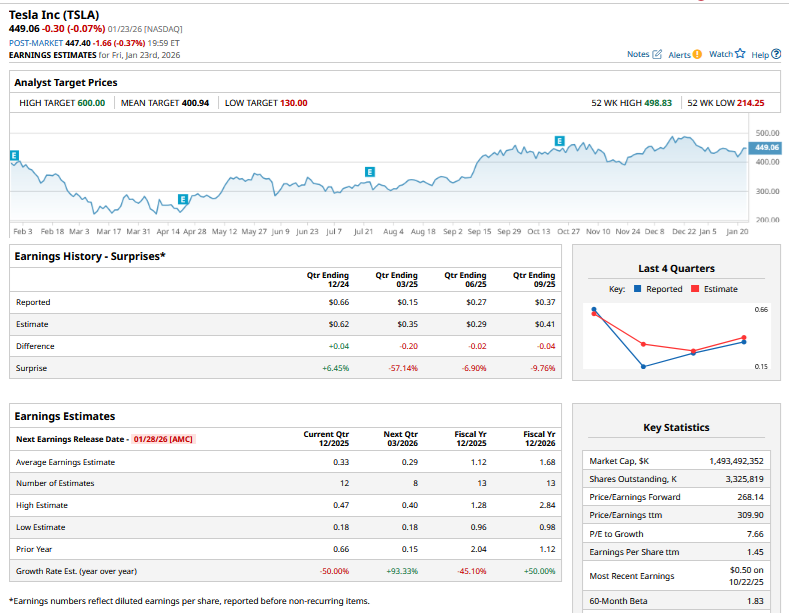

Analysts expect Tesla’s earnings per share (EPS) to fall 50% YoY to $0.33. Tesla’s earnings have fallen significantly over the last couple of years as its once industry-leading margins have withered away amid the price cuts.

What to Watch in Tesla’s Q4 Earnings Call

The overall mood during Tesla’s Q4 earnings call might not be very different from what we have seen in recent quarters, where CEO Elon Musk has been positioning the company as an artificial intelligence (AI) play rather than merely being an automaker. However, as I have noted previously, the automotive business is still key for Tesla as it brings in the much-needed cash flows that the company can then plow into other businesses like the Optimus humanoid robot, which are currently in the investment phase and at least a couple of years away from full-scale commercialization.

Here is what I would watch in Tesla’s Q4 earnings call:

- Delivery Guidance: Tesla’s deliveries have now fallen for two consecutive years, and the 2026 outlook is not looking too promising, both stateside and globally. In the U.S., expiration of the tax credits is expected to dampen electric vehicle (EV) sales, and Musk himself has warned of a “few rough quarters.” Globally, Chinese EV companies are making headway, among others, at Tesla’s cost. I would also watch out for Musk’s views on the changing landscape for Chinese EV companies, where Canada is lowering tariffs on Chinese EVs and the EU is considering replacing tariffs with a price floor. Things haven't been rosy for Tesla globally, and there are reports of it offering incentives in India to spur sales.

- Cybercab Production Timeline: Musk shared on social media that Cybercab production is set to begin in April. He, however, warned that the early “production rate will be agonizingly slow,” while expressing optimism that eventually it would be “insanely fast.” During the Q4 earnings call, I would look for more color on the 2026 production plan for the model on which Tesla’s delivery outlook for the next couple of years hinges.

- Robotaxi Expansion and Monetization: I would also watch out for comments on the robotaxi expansion and monetization plans, as well as the progress on full autonomy, which, by Musk’s assertion, is key to Tesla’s valuation.

- FSD Subscription: Tesla has done away with the one-time subscription for its full self-driving (FSD) and instead moved to a $99 monthly fee. I would watch out for comments on any changes in adoption rates that the company witnessed in the early days under the new pricing. At the World Economic Forum (WEF) in Davos, Musk expressed confidence that FSD could be approved in China and the EU as early as next month. If that were to happen, it would be a key positive for Tesla and help the company improve its production proposition in both the markets where it has been losing market share to Chinese rivals. During the earnings call, the company might provide an update on its discussions with regulators in these countries.

Should You Buy or Sell TSLA Stock

Tesla’s earnings for the first three quarters of 2025 left markets largely disappointed. The stock did rise following the Q1 confessional as Musk’s talk about disassociation from President Trump’s Department of Government Efficiency (DOGE)—something he subsequently did—helped buoy sentiments and took attention off an otherwise not-so-good earnings report.

However, the stock fell following the Q2 and Q3 reports, and markets did not buy into Musk’s bold promises, including the often-repeated claim of Tesla eventually becoming the biggest company globally.

Meanwhile, I am not too bullish on TSLA stock heading into the Q4 report and expect yet another tepid performance from the company, which has been struggling with growth. The headwinds for Tesla’s automotive business have only amplified, and while AI products could still drive long-term growth, I don’t find any margin of safety in the company whose market cap is over $1.4 trillion. Overall, I continue to maintain a small investment in Tesla but am not inclined to add more shares at these price levels.

On the date of publication, Mohit Oberoi had a position in: TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart