Financial derivatives exchange CME Group (NASDAQ:CME) met Wall Street’s revenue expectations in Q3 CY2025, but sales fell by 3% year on year to $1.54 billion. Its non-GAAP profit of $2.68 per share was 2% above analysts’ consensus estimates.

Is now the time to buy CME Group? Find out by accessing our full research report, it’s free for active Edge members.

CME Group (CME) Q3 CY2025 Highlights:

- Revenue: $1.54 billion vs analyst estimates of $1.54 billion (3% year-on-year decline, in line)

- Pre-tax Profit: $1.18 billion (76.5% margin, flat year on year)

- Adjusted EPS: $2.68 vs analyst estimates of $2.63 (2% beat)

- Market Capitalization: $96.8 billion

"Global clients continued relying on CME Group markets across all asset classes as they sought to navigate risk and pursue opportunities amid ongoing uncertainty in Q3," said Terry Duffy, Chairman and Chief Executive Officer, CME Group.

Company Overview

Born from the Chicago Mercantile Exchange founded in 1898 as a butter and egg trading venue, CME Group (NASDAQ:CME) operates the world's largest derivatives marketplace where traders can buy and sell futures and options contracts across interest rates, equities, currencies, commodities, and more.

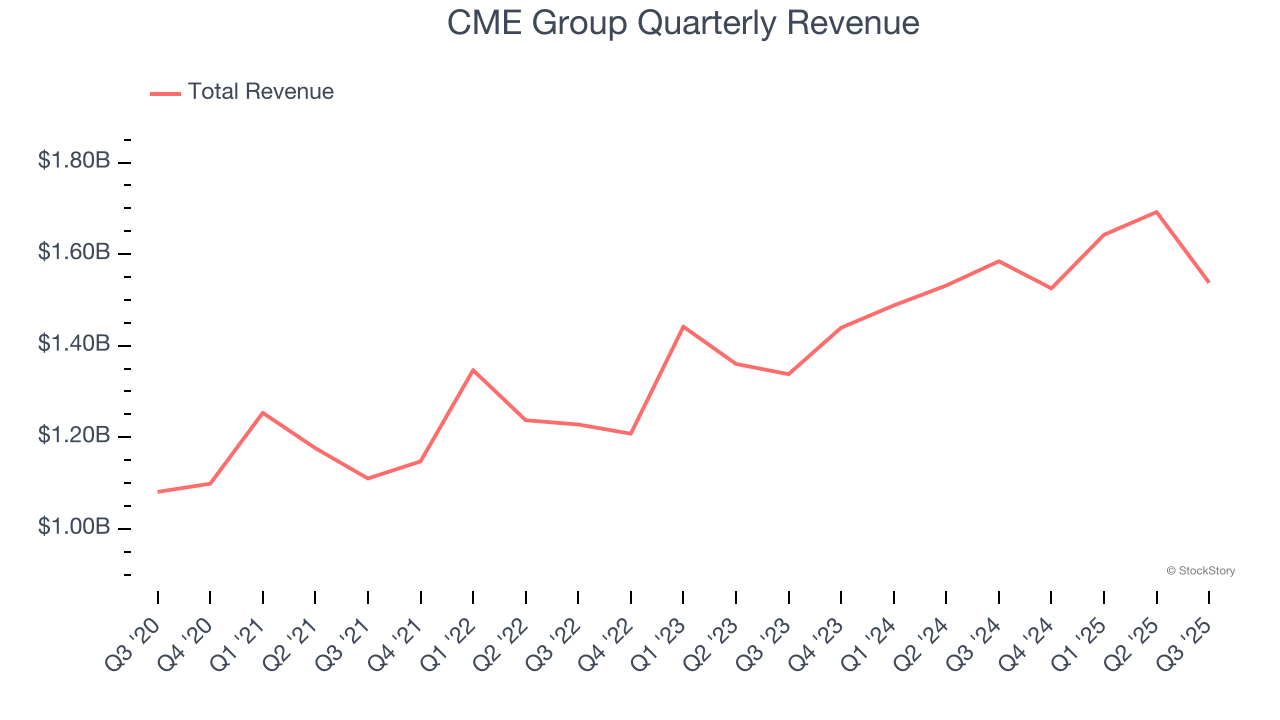

Revenue Growth

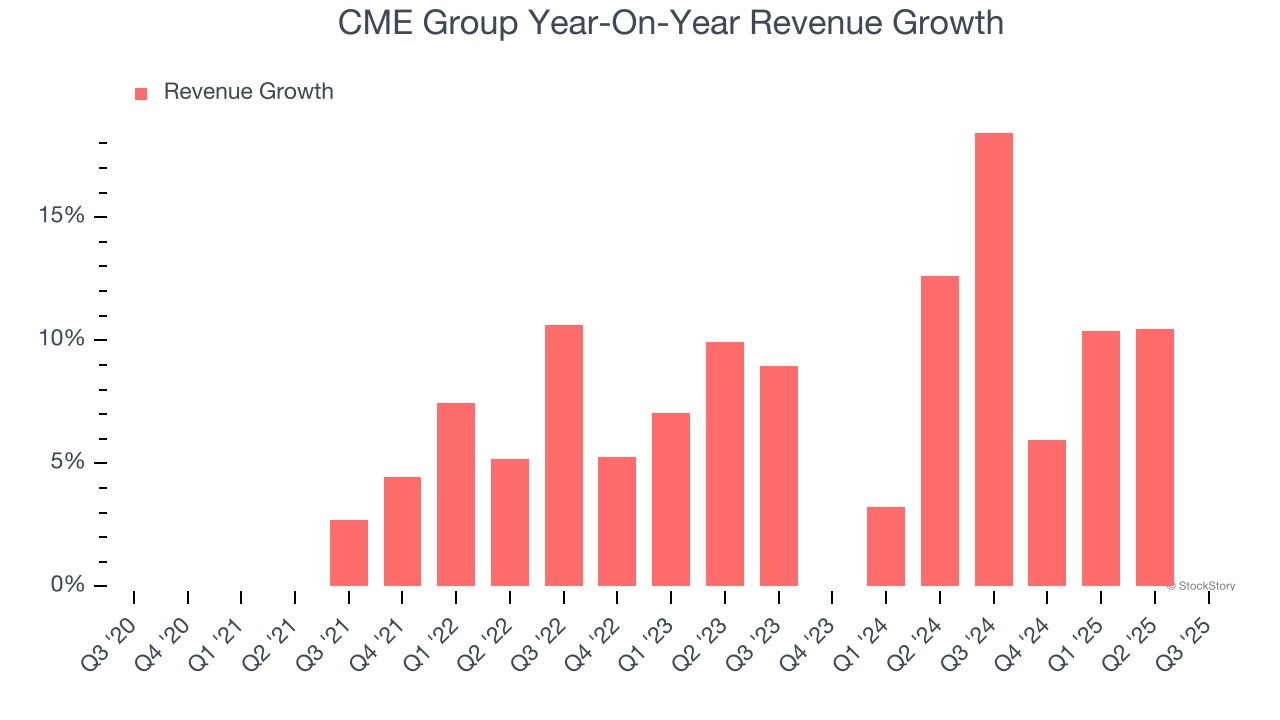

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, CME Group’s 5.4% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the financials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. CME Group’s annualized revenue growth of 9.4% over the last two years is above its five-year trend, suggesting some bright spots.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, CME Group reported a rather uninspiring 3% year-on-year revenue decline to $1.54 billion of revenue, in line with Wall Street’s estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Key Takeaways from CME Group’s Q3 Results

We struggled to find many positives in these results. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 1.3% to $265.24 immediately following the results.

So do we think CME Group is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.