Chegg has gotten torched over the last six months - since October 2024, its stock price has dropped 68.4% to a new 52-week low of $0.51 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Chegg, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even with the cheaper entry price, we don't have much confidence in Chegg. Here are three reasons why CHGG doesn't excite us and a stock we'd rather own.

Why Do We Think Chegg Will Underperform?

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

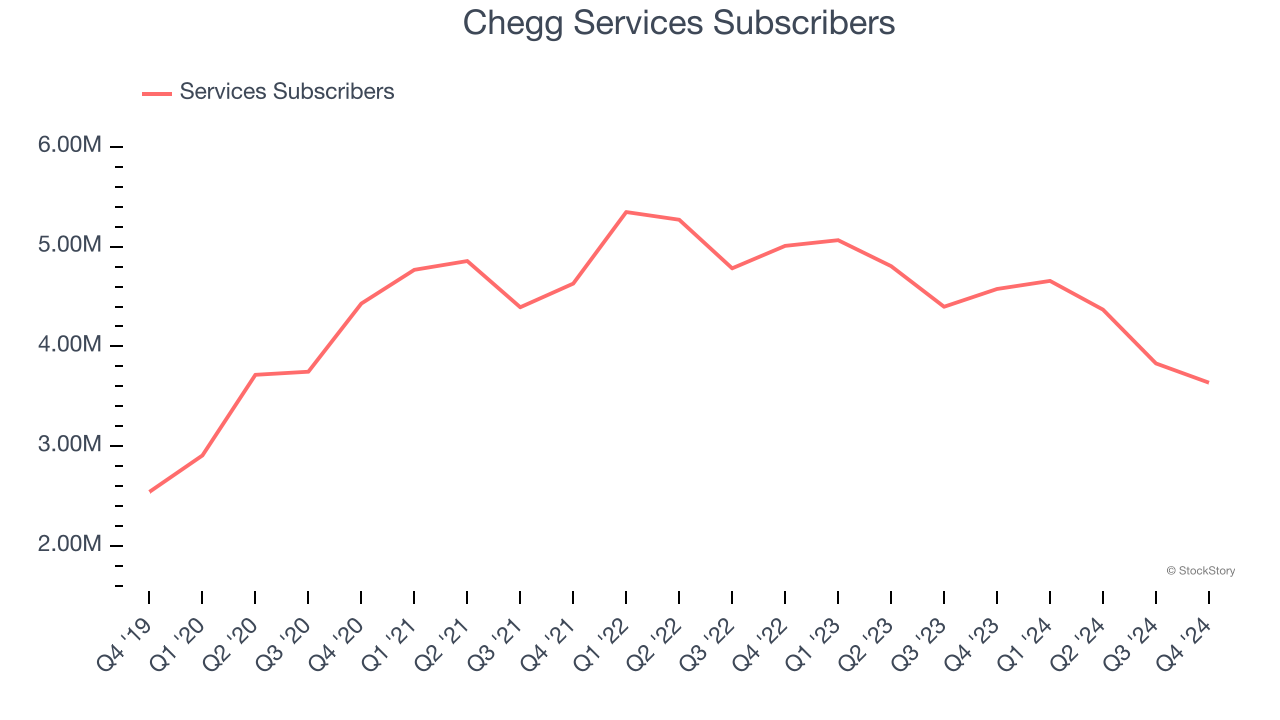

1. Declining Services Subscribers Reflect Product Weakness

As a subscription-based app, Chegg generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Chegg struggled with new customer acquisition over the last two years as its services subscribers have declined by 10.2% annually to 3.64 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Chegg wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

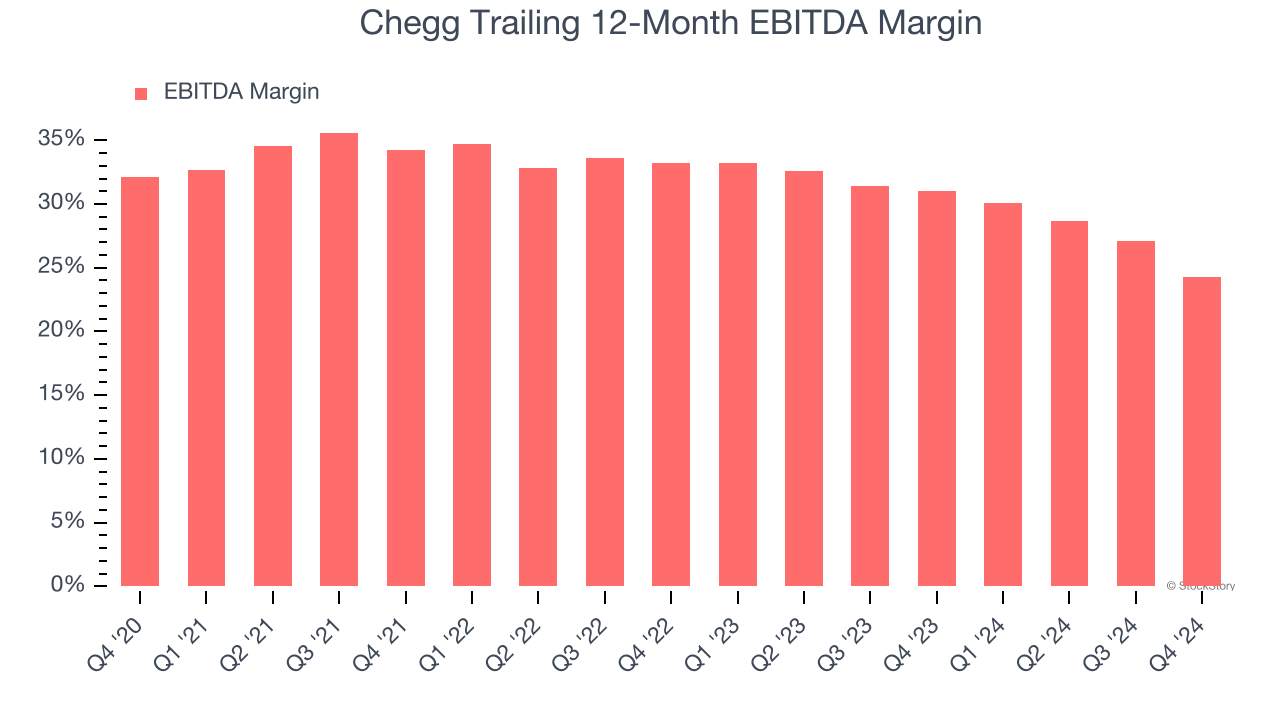

2. Shrinking EBITDA Margin

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Looking at the trend in its profitability, Chegg’s EBITDA margin decreased by 10 percentage points over the last few years. Even though its historical margin was healthy, shareholders will want to see Chegg become more profitable in the future. Its EBITDA margin for the trailing 12 months was 24.2%.

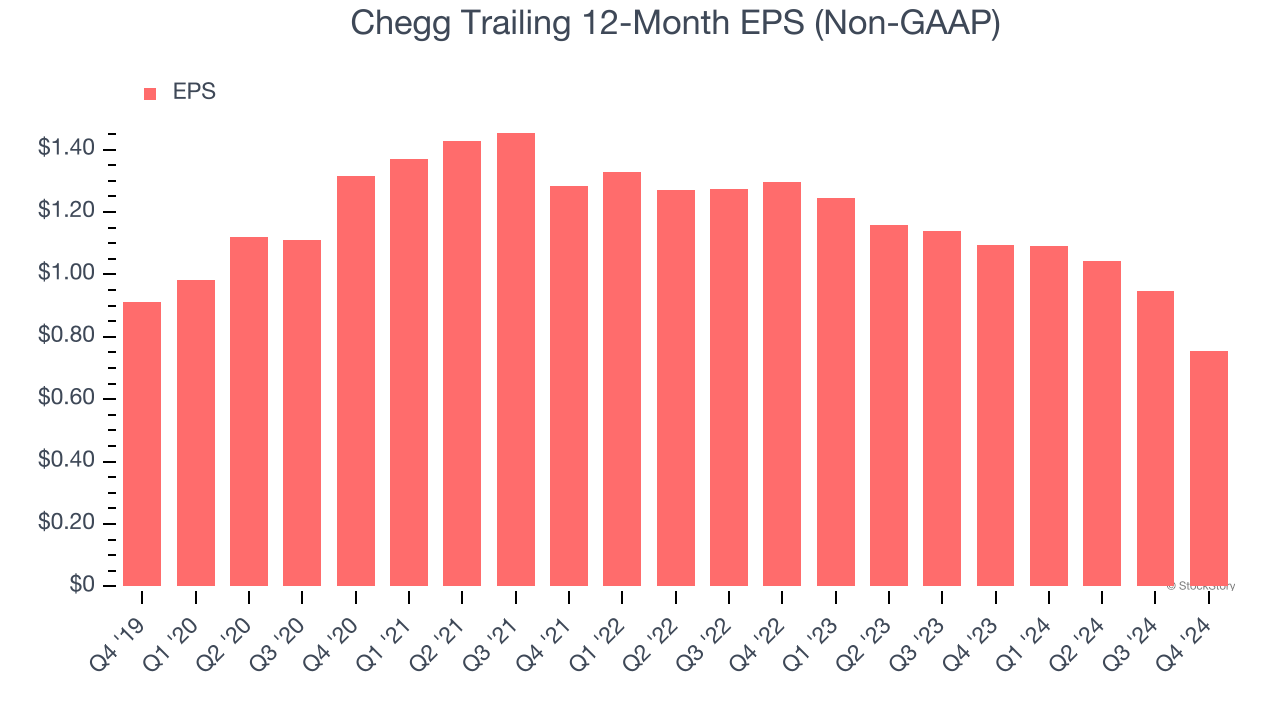

3. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Chegg, its EPS declined by 16.3% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Chegg, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 0.4× forward EV-to-EBITDA (or $0.51 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Chegg

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.