As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at vertical software stocks, starting with Agilysys (NASDAQ:AGYS).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 3.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 20.7% since the latest earnings results.

Agilysys (NASDAQ:AGYS)

Originally a subsidiary of Pioneer-Standard Electronics that distributed electronic components, Agilysys (NASDAQ:AGYS) offers a software-as-service platform that helps hotels, resorts, restaurants, and other hospitality businesses manage their operations and workflows.

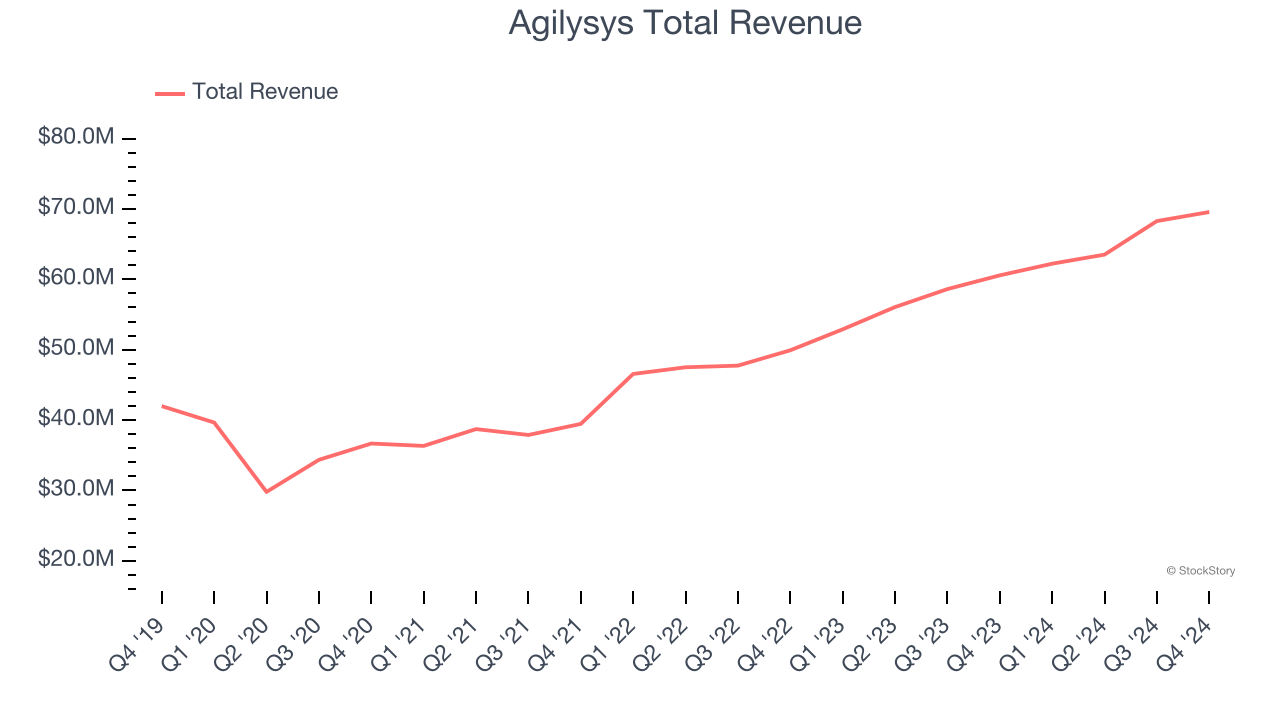

Agilysys reported revenues of $69.56 million, up 14.9% year on year. This print fell short of analysts’ expectations by 5.2%. Overall, it was a slower quarter for the company with full-year revenue guidance missing analysts’ expectations.

Agilysys delivered the weakest performance against analyst estimates of the whole group. The stock is down 44.8% since reporting and currently trades at $69.54.

Read our full report on Agilysys here, it’s free.

Best Q4: Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business, Upstart (NASDAQ:UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

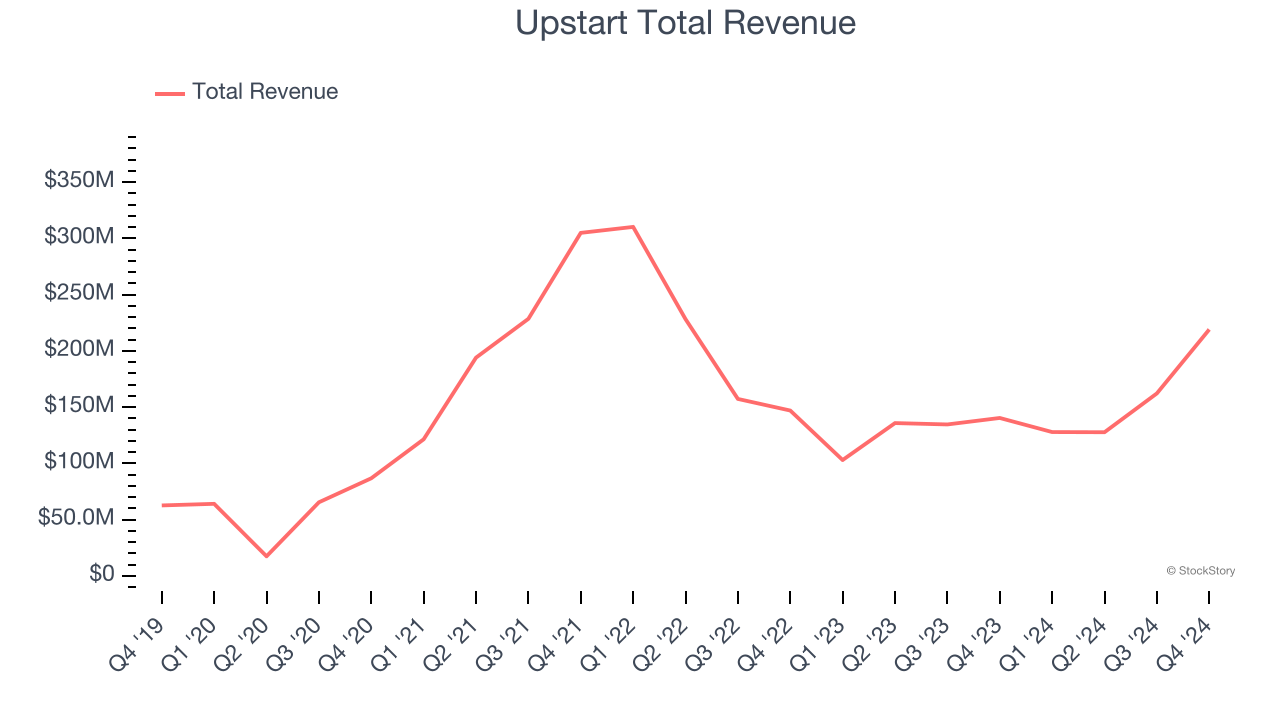

Upstart reported revenues of $219 million, up 56.1% year on year, outperforming analysts’ expectations by 20.1%. The business had an exceptional quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

Upstart pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 42.5% since reporting. It currently trades at $38.70.

Is now the time to buy Upstart? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: PTC (NASDAQ:PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ:PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.

PTC reported revenues of $565.1 million, up 2.7% year on year, exceeding analysts’ expectations by 1.9%. Still, it was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations and EPS guidance for next quarter missing analysts’ expectations significantly.

As expected, the stock is down 25.6% since the results and currently trades at $141.09.

Read our full analysis of PTC’s results here.

Q2 Holdings (NYSE:QTWO)

Founded in 2004 by Hank Seale, Q2 (NYSE:QTWO) offers software-as-a-service that enables small banks to provide online banking and consumer lending services to their clients.

Q2 Holdings reported revenues of $183 million, up 12.9% year on year. This number surpassed analysts’ expectations by 1.7%. Overall, it was a very strong quarter as it also logged EBITDA guidance for next quarter exceeding analysts’ expectations.

The stock is down 23.7% since reporting and currently trades at $70.20.

Read our full, actionable report on Q2 Holdings here, it’s free.

Olo (NYSE:OLO)

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Olo reported revenues of $76.07 million, up 20.7% year on year. This print topped analysts’ expectations by 4.5%. It was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

The stock is down 12.7% since reporting and currently trades at $5.76.

Read our full, actionable report on Olo here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.