Although Stryker has dropped 5.3% to $335.22 per share over the past six months, it has beaten the S&P 500 by 8.6 percentage points.

Following the pullback, is this a buying opportunity for SYK? Find out in our full research report, it’s free.

Why Do Investors Watch SYK Stock?

With over 150 million patients impacted annually through its innovative healthcare technologies, Stryker (NYSE:SYK) develops and manufactures advanced medical devices and equipment across orthopedics, surgical tools, neurotechnology, and patient care solutions.

Three Things to Like:

1. Organic Growth Indicates Solid Core Business

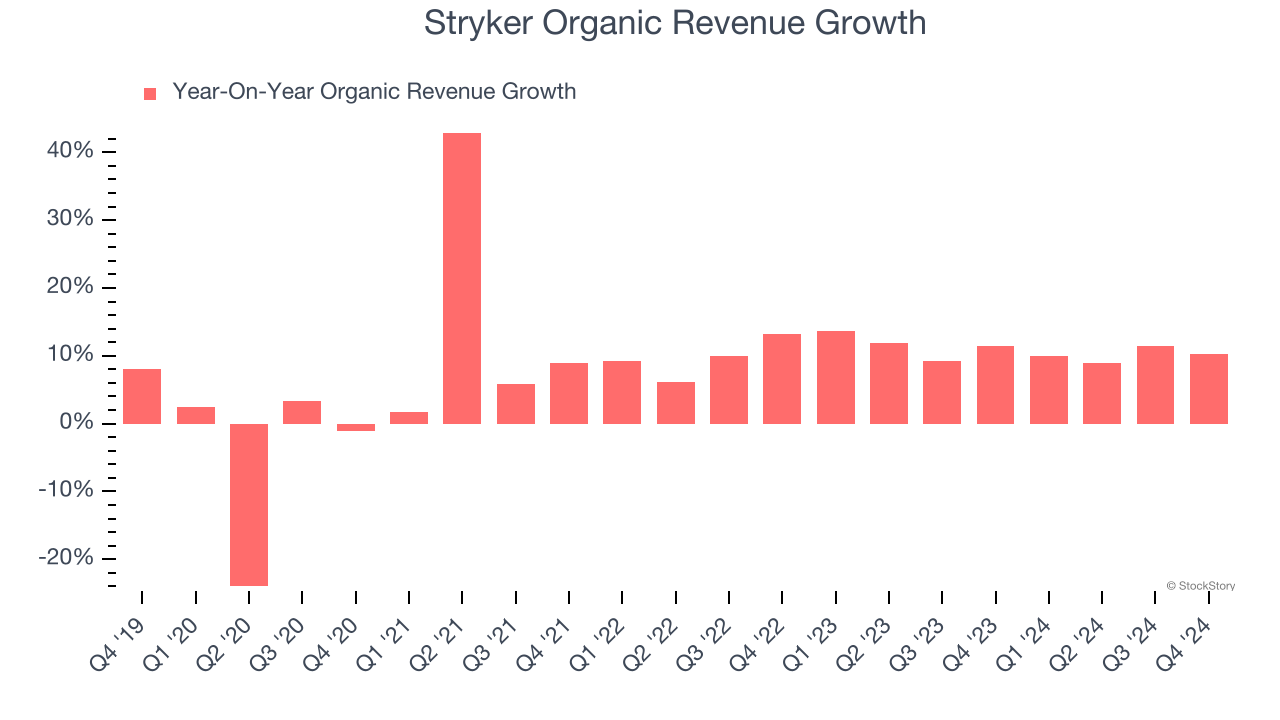

We can better understand Medical Devices & Supplies - Diversified companies by analyzing their organic revenue. This metric gives visibility into Stryker’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Stryker’s organic revenue averaged 10.8% year-on-year growth. This performance was solid and shows it can expand steadily without relying on expensive (and risky) acquisitions.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $22.6 billion in revenue over the past 12 months, Stryker sports economies of scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

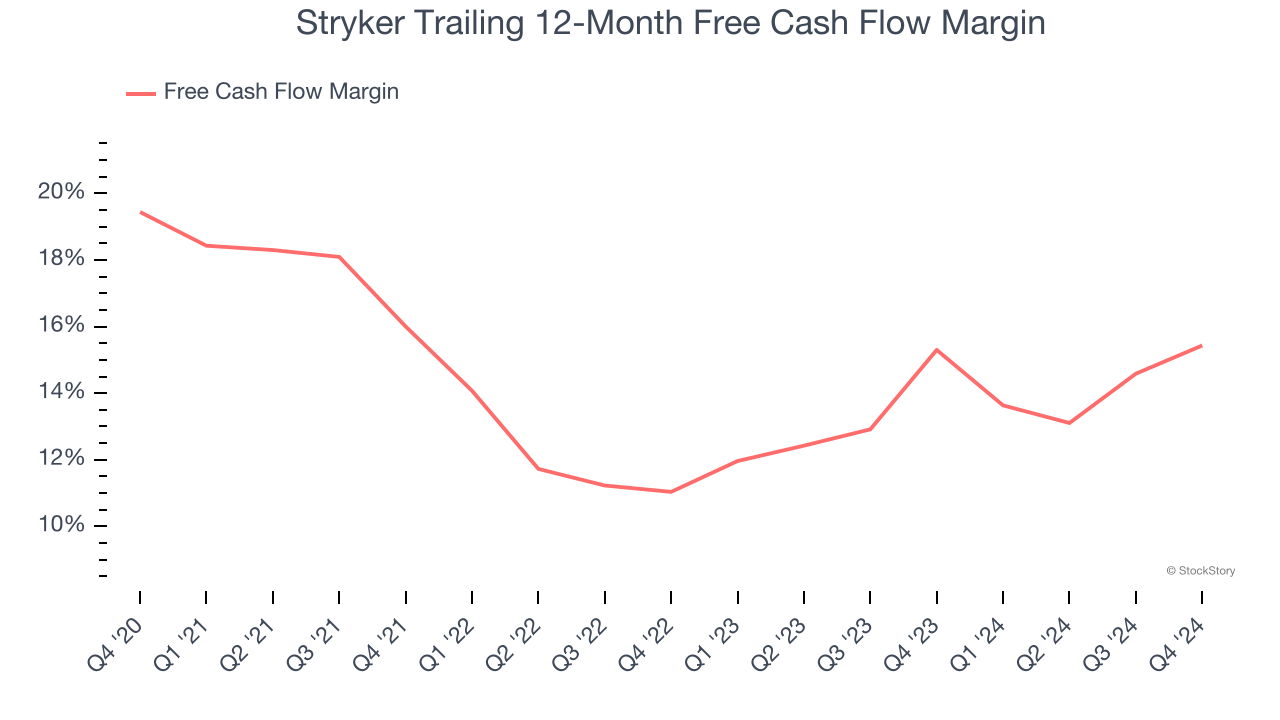

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Stryker has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 15.3% over the last five years, quite impressive for a healthcare business.

Final Judgment

Stryker is an interesting business with potential. With the recent decline, the stock trades at 25.1× forward price-to-earnings (or $335.22 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Stryker

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.