Radian Group has been treading water for the past six months, recording a small return of 1.9% while holding steady at $33.99.

Is there a buying opportunity in Radian Group, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Radian Group Not Exciting?

We're swiping left on Radian Group for now. Here are three reasons why you should be careful with RDN and a stock we'd rather own.

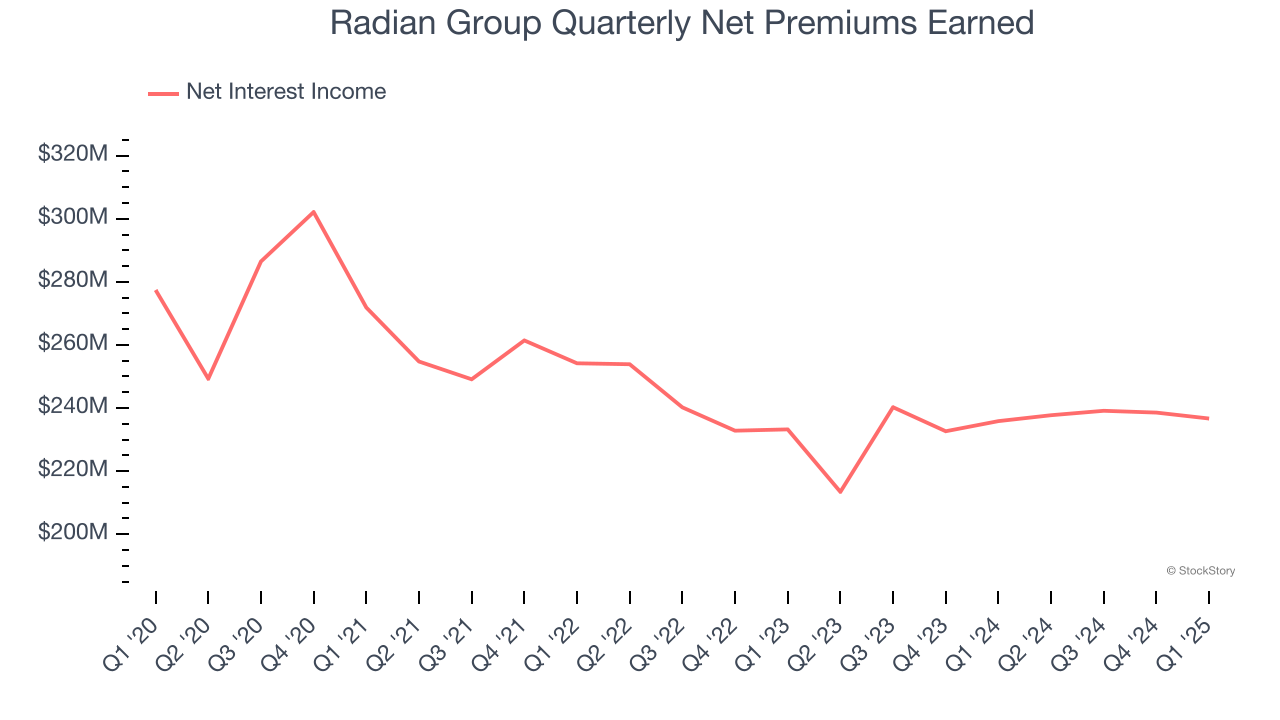

1. Declining Net Premiums Earned Reflects Weakness

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

Radian Group’s net premiums earned has declined by 3.8% annually over the last four years, much worse than the broader insurance industry.

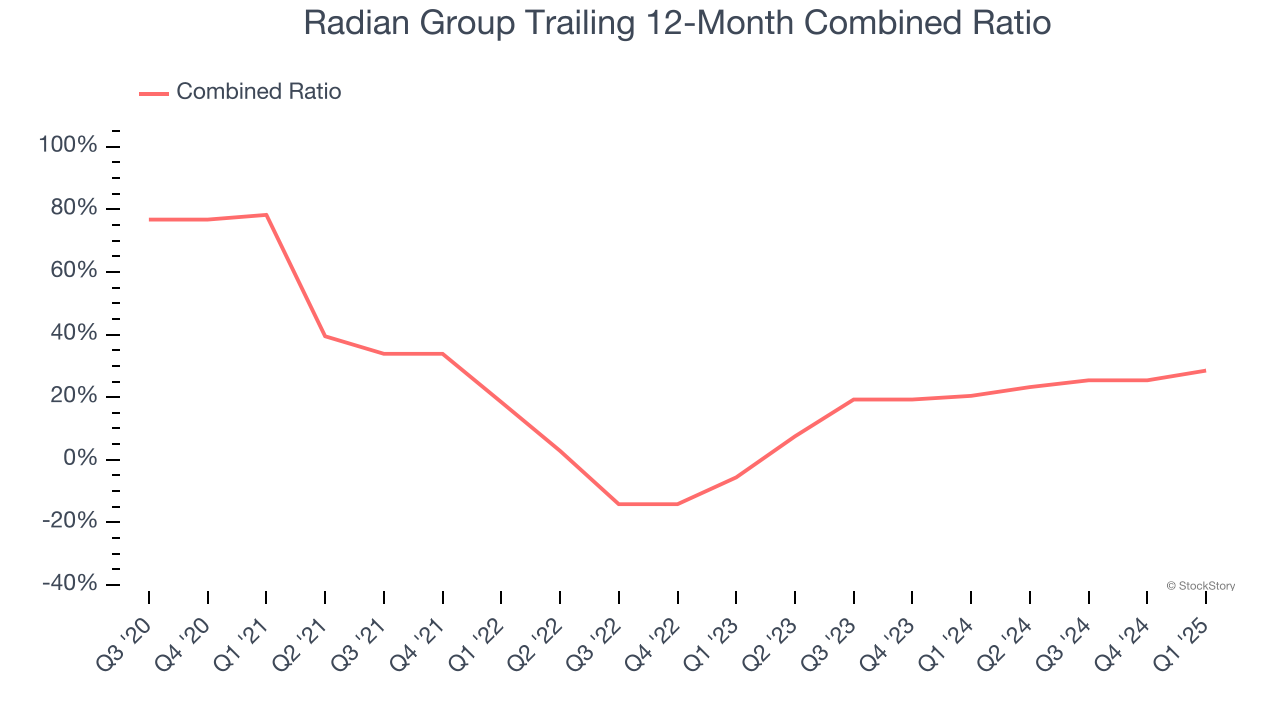

2. Deteriorating Combined Ratio

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

Combined ratio sums operating costs (salaries, commissions, overhead) with what is paid out in claims (losses) and divides this by net premiums earned. Combined ratios under 100% means profits while ones over 100% mean losses on its core operations of selling insurance policies.

Over the last four years, Radian Group’s combined ratio has decreased by 49.7 percentage points, clocking in at 28.5% for the past 12 months. Said differently, the company’s expenses have grown at a slower rate than revenue, which is always a positive sign.

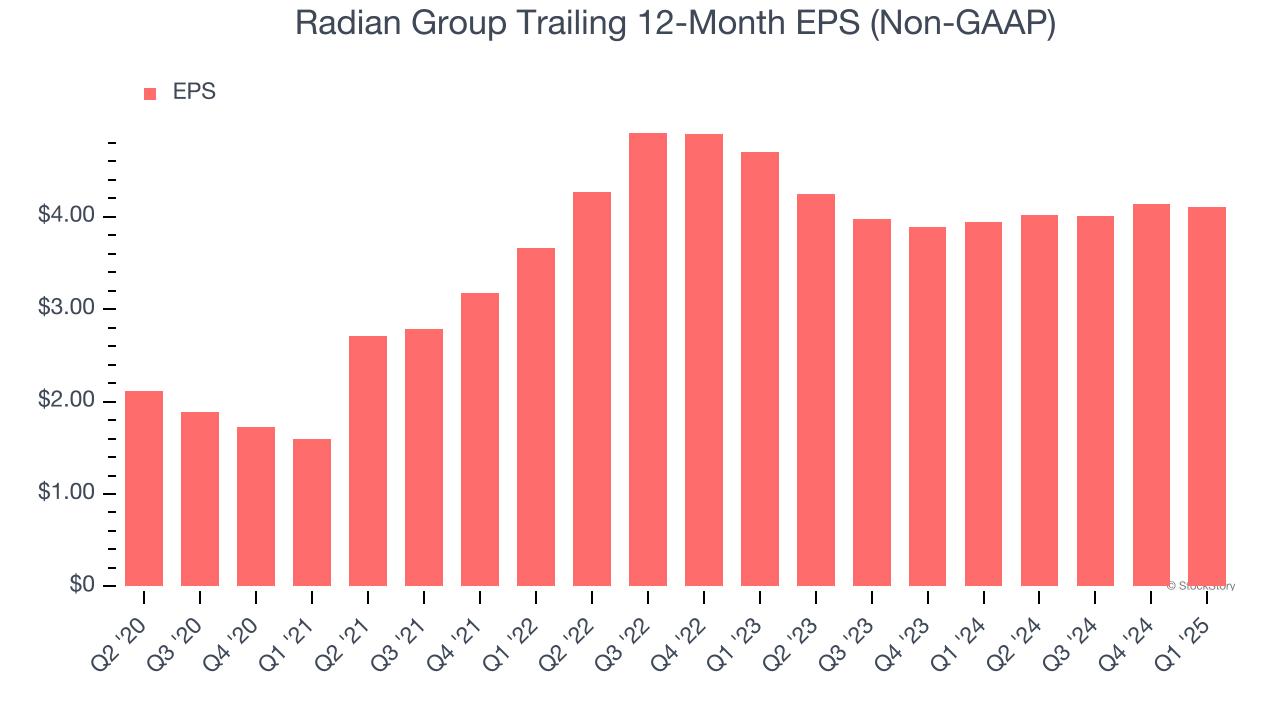

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Radian Group’s EPS grew at a weak 4.7% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.9% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

Radian Group’s business quality ultimately falls short of our standards. That said, the stock currently trades at 1× forward P/B (or $33.99 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Radian Group

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.