TreeHouse Foods’s stock price has taken a beating over the past six months, shedding 42.3% of its value and falling to $20.24 per share. This may have investors wondering how to approach the situation.

Is now the time to buy TreeHouse Foods, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think TreeHouse Foods Will Underperform?

Even though the stock has become cheaper, we're swiping left on TreeHouse Foods for now. Here are three reasons why THS doesn't excite us and a stock we'd rather own.

1. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

TreeHouse Foods’s average quarterly sales volumes have shrunk by 2.3% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

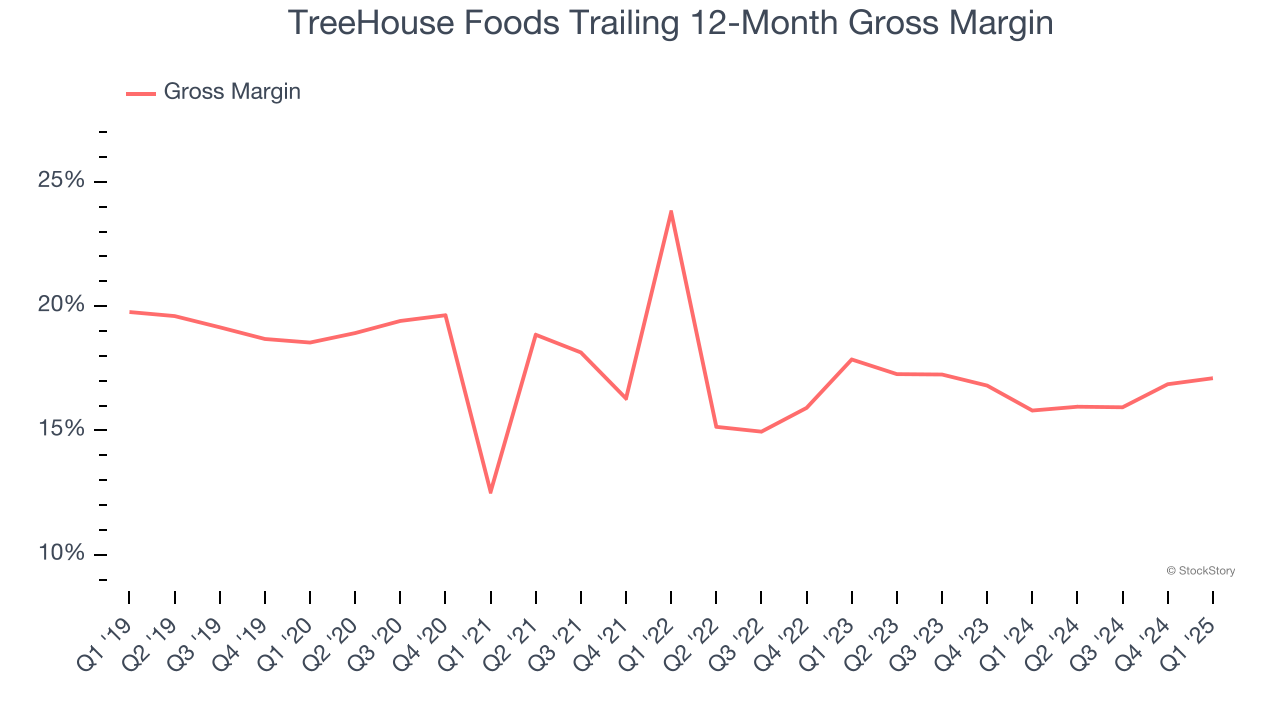

2. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

TreeHouse Foods has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 16.4% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $83.55 went towards paying for raw materials, production of goods, transportation, and distribution.

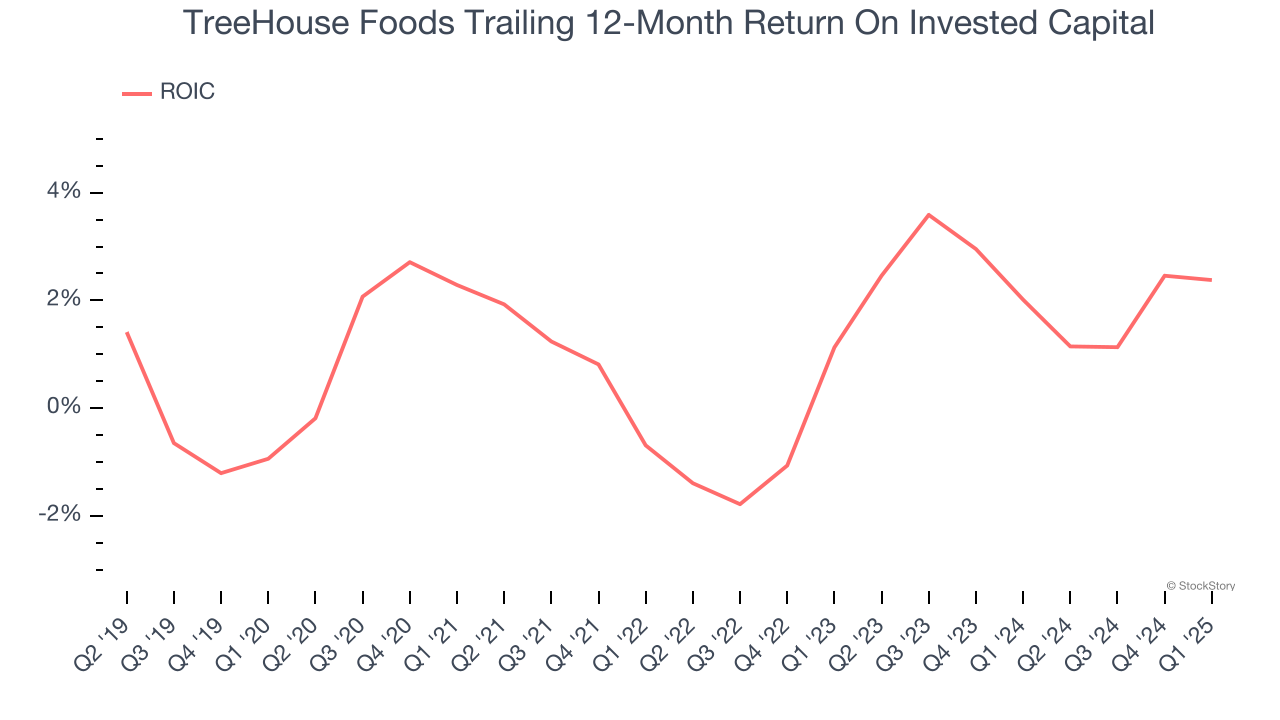

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

TreeHouse Foods historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.4%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of TreeHouse Foods, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 10.4× forward P/E (or $20.24 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment. Let us point you toward one of our top software and edge computing picks.

Stocks We Like More Than TreeHouse Foods

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.