Over the past six months, Hershey has been a great trade, beating the S&P 500 by 5.5%. Its stock price has climbed to $168.32, representing a healthy 9.6% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Hershey, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Hershey Not Exciting?

We’re glad investors have benefited from the price increase, but we're cautious about Hershey. Here are three reasons why HSY doesn't excite us and a stock we'd rather own.

1. Demand Slipping as Sales Volumes Decline

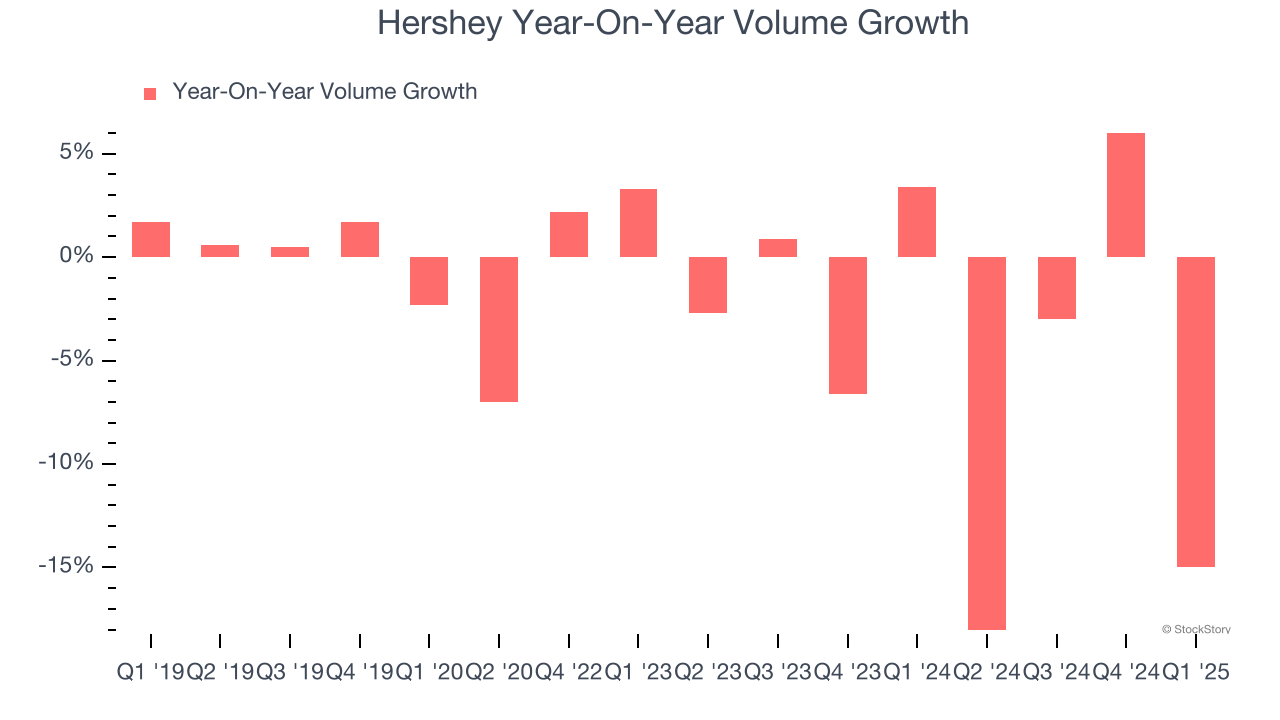

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Hershey’s average quarterly sales volumes have shrunk by 4.4% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

2. Core Business Falling Behind as Demand Plateaus

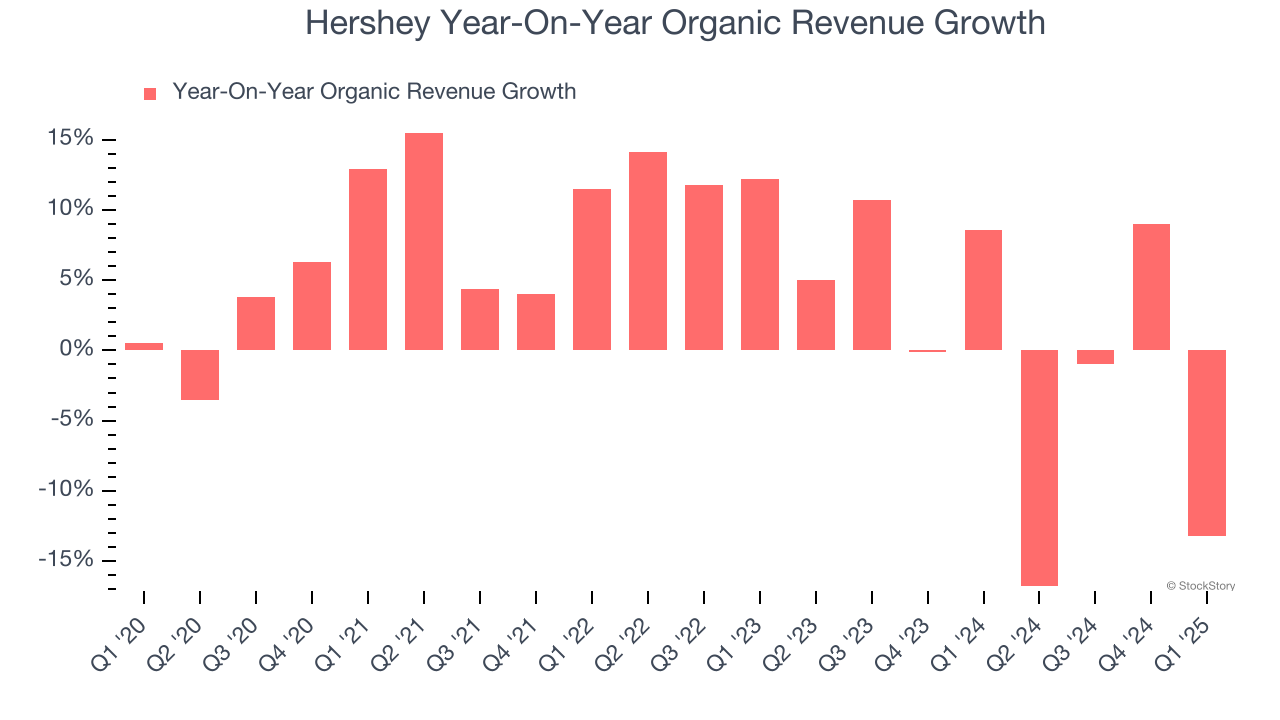

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Hershey’s products has barely risen over the last eight quarters. On average, the company’s organic sales have been flat.

3. Shrinking Operating Margin

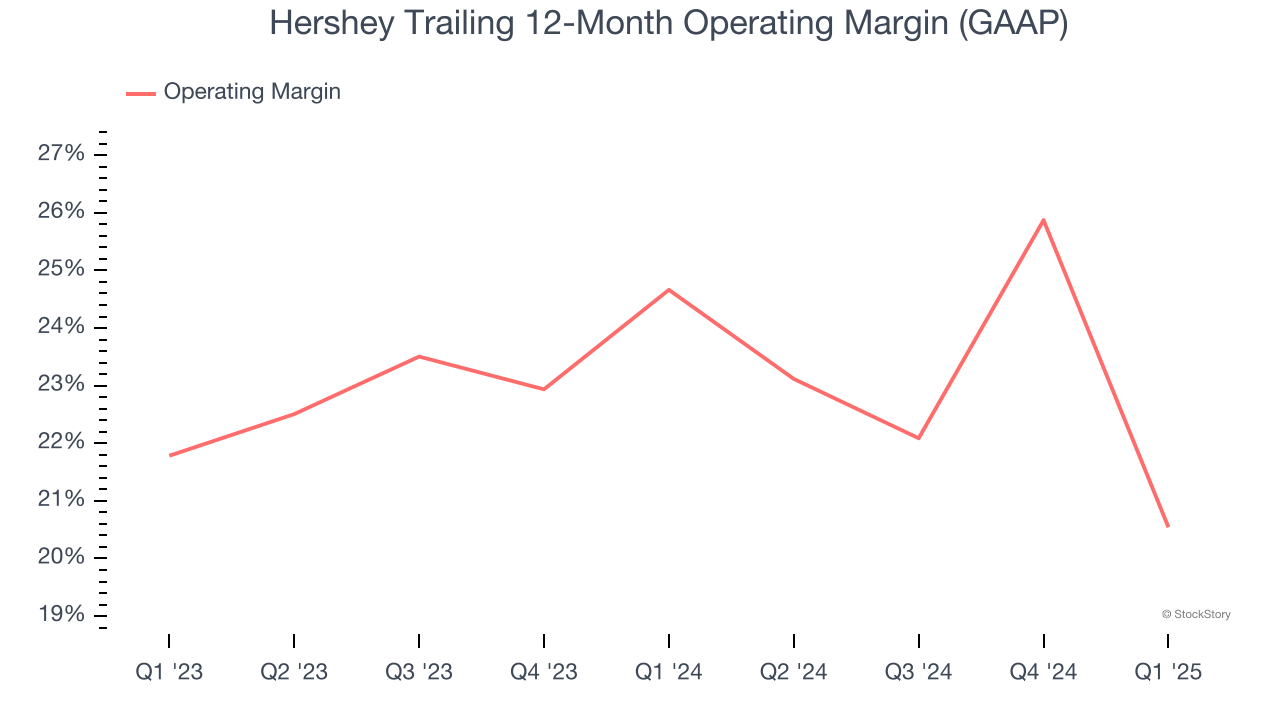

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

Analyzing the trend in its profitability, Hershey’s operating margin decreased by 4.1 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 20.5%.

Final Judgment

Hershey’s business quality ultimately falls short of our standards. With its shares beating the market recently, the stock trades at 27.8× forward P/E (or $168.32 per share). This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Like More Than Hershey

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.