What a brutal six months it’s been for Lantheus. The stock has dropped 21.9% and now trades at a new 52-week low of $73.50, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now a good time to buy LNTH? Find out in our full research report, it’s free.

Why Does Lantheus Spark Debate?

Pioneering the "Find, Fight and Follow" approach to disease management, Lantheus Holdings (NASDAQGM:LNTH) develops and commercializes radiopharmaceuticals and other imaging agents that help healthcare professionals detect, diagnose, and treat diseases.

Two Things to Like:

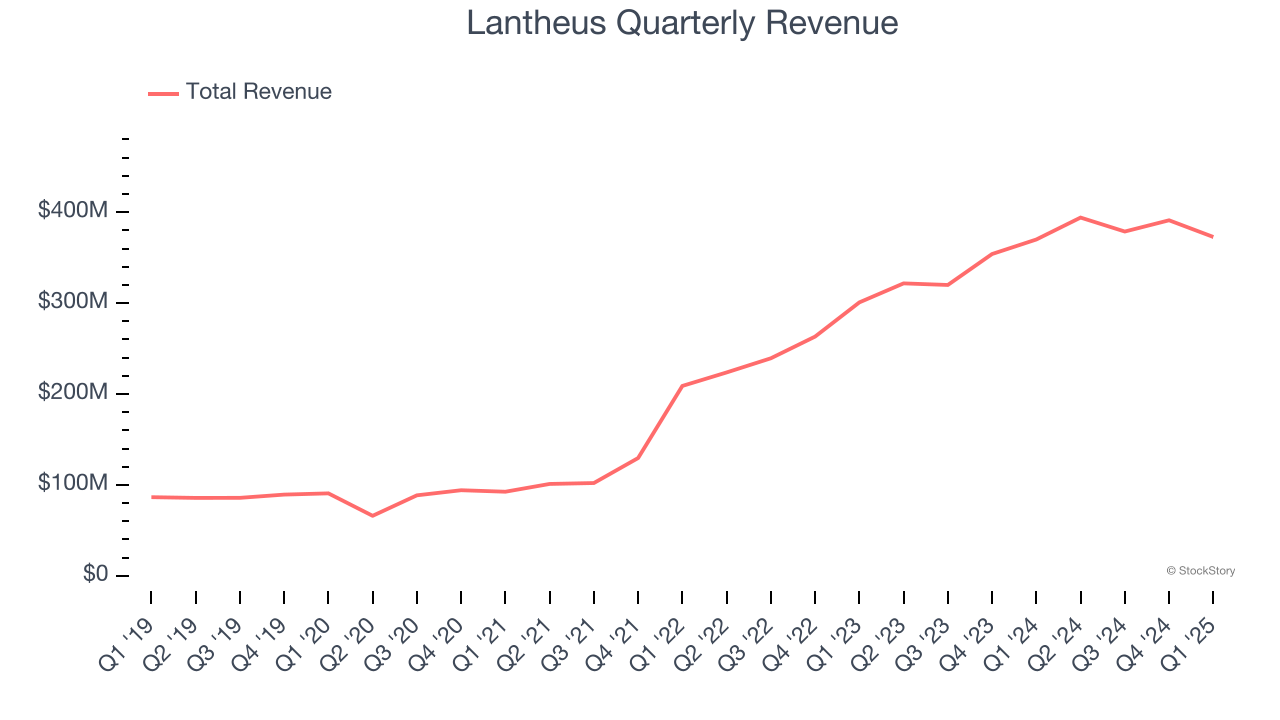

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Lantheus’s 34.3% annualized revenue growth over the last five years was incredible. Its growth surpassed the average healthcare company and shows its offerings resonate with customers.

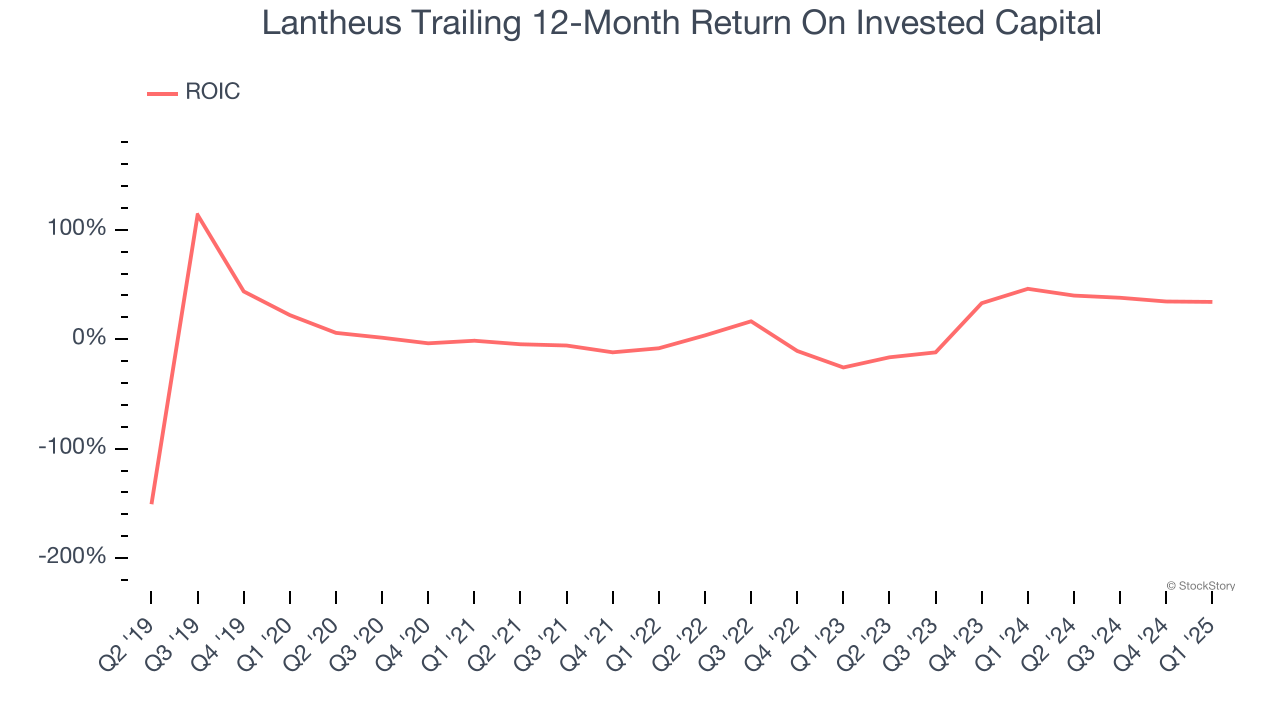

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Lantheus’s ROIC has increased. This is a great sign when paired with its already strong returns, but we also recognize its lack of profitable growth during the COVID era was the primary reason for the change.

One Reason to be Careful:

Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.54 billion in revenue over the past 12 months, Lantheus is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive. On the bright side, Lantheus’s smaller revenue base allows it to grow faster if it can execute well.

Final Judgment

Lantheus’s merits more than compensate for its flaws. With the recent decline, the stock trades at 10.2× forward P/E (or $73.50 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Lantheus

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.