Eaton Corp Plc (ETN)

373.53

-1.03 (-0.27%)

NYSE · Last Trade: Feb 26th, 12:18 AM EST

MENLO PARK, CA — In a move that signals a tectonic shift in the artificial intelligence hardware market, Advanced Micro Devices, Inc. (NASDAQ: AMD) and Meta Platforms, Inc. (NASDAQ: META) announced a definitive multi-year agreement today, February 24, 2026, to deploy up to 6 gigawatts (GW) of GPU capacity across Meta’

Via MarketMinute · February 24, 2026

Via Benzinga · February 23, 2026

The dream of a "pivot" to lower interest rates in early 2026 has been dealt a staggering blow following the release of the latest Personal Consumption Expenditures (PCE) price index. On February 23, 2026, investors are grappling with data that confirms inflation is not merely "sticky" but potentially re-accelerating, forcing

Via MarketMinute · February 23, 2026

Via Benzinga · February 23, 2026

Under certain market and economic conditions, Morgan Stanley's stock could rise even further.

Via The Motley Fool · February 20, 2026

Edison EIX Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 18, 2026

Via MarketBeat · February 18, 2026

Auto insurance provider Mercury General (NYSE:MCY) announced better-than-expected revenue in Q4 CY2025, with sales up 11.3% year on year to $1.54 billion. Its GAAP profit of $3.66 per share was 43% above analysts’ consensus estimates.

Via StockStory · February 17, 2026

On February 11, 2026, the financial markets witnessed a historic milestone for one of America’s most storied industrial giants. Caterpillar Inc. (NYSE: CAT) saw its stock price surge to an all-time high, closing at $775.00 after an intraday peak of $775.54. This rally, which saw the stock

Via MarketMinute · February 17, 2026

Copper futures drifted lower this week, settling near the $5.90 per pound mark as the global commodities market grapples with a seasonal slowdown in China. As the world’s largest consumer of the "red metal," China’s transition into the Lunar New Year holiday has led to a significant

Via MarketMinute · February 16, 2026

The infrastructure of artificial intelligence reached a fever pitch today as shares of Vertiv Holdings Co. (NYSE: VRT) surged 23%, hitting a record high of $248.51. The market’s explosive reaction followed a Q4 2025 earnings report that blew past even the most bullish Wall Street projections, signaling that

Via MarketMinute · February 12, 2026

The technology sector has officially entered the era of the "Gigawatt Supercycle." As of February 12, 2026, new financial projections indicate that the world’s six most aggressive AI infrastructure spenders are on track to exceed a combined $500 billion in capital expenditures this year alone, with some analysts now

Via MarketMinute · February 12, 2026

As of February 11, 2026, the global financial community is fixated on the S&P 500 (INDEXSP: .INX) as it battles to secure a foothold above the historic 7,000-point milestone. After a relentless multi-year rally fueled by the transition from artificial intelligence speculation to large-scale industrialization, the index has

Via MarketMinute · February 11, 2026

Gapping S&P500 stocks in Wednesday's sessionchartmill.com

Via Chartmill · February 11, 2026

Today, February 11, 2026, the equity markets witnessed a defining moment in the artificial intelligence (AI) infrastructure cycle as Vertiv Holdings Co. (NYSE: VRT) released its fourth-quarter and full-year 2025 financial results. Long positioned as the "plumbing" of the digital age, Vertiv has transitioned into the premier architect of the AI era. With a staggering [...]

Via Finterra · February 11, 2026

Although Eaton has outperformed relative to the SPX over the past year, Wall Street analysts maintain a cautiously optimistic outlook about the stock’s prospects.

Via Barchart.com · February 11, 2026

These S&P500 stocks are moving in today's pre-market sessionchartmill.com

Via Chartmill · February 11, 2026

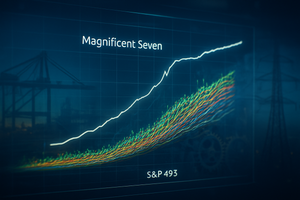

As of February 10, 2026, the long-standing "two-speed" economy that defined the post-pandemic era has finally reached a historic turning point. For years, a handful of mega-cap technology titans—the "Magnificent Seven"—carried the weight of the entire U.S. stock market on their shoulders, while the remaining 493 companies

Via MarketMinute · February 10, 2026

Eaton, Texas Instruments, and Brookfield Renewable are all set to benefit as AI infrastructure spending heats up.

Via The Motley Fool · February 7, 2026

As of February 6, 2026, the dominant narrative on Wall Street has shifted from the virtual to the tangible. After years of dominance by Silicon Valley’s software giants, a powerful "Great Rotation" is underway, with institutional capital aggressively migrating toward the backbone of the physical economy. Investors are increasingly

Via MarketMinute · February 6, 2026

The tech world was sent into a tailspin this week as Amazon.com Inc. (NASDAQ: AMZN) unveiled a staggering $200 billion capital expenditure guidance for 2026, marking the largest single-year investment commitment by any corporation in history. While the retail and cloud giant reported record-breaking quarterly revenue and a significant

Via MarketMinute · February 6, 2026

Data centers need power management and cooling solutions, and this company makes it possible.

Via The Motley Fool · February 5, 2026

Join us as we explore Eaton's potential in the industrial sector and why it received high ratings from our analysts. Is this stock a hidden gem worth your investment?

Via The Motley Fool · February 4, 2026

Eaton (ETN) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 3, 2026