Oracle Corp (ORCL)

164.58

-4.43 (-2.62%)

NYSE · Last Trade: Jan 31st, 12:17 PM EST

Microsoft is dependent on OpenAI and struggling to sell its own AI-powered products.

Via The Motley Fool · January 31, 2026

Oracle remains a high-risk, high-potential-reward artificial intelligence stock.

Via The Motley Fool · January 31, 2026

The Vanguard Information Technology ETF is missing some key long-term pieces.

Via The Motley Fool · January 31, 2026

International Business Machines (NYSE: IBM) has stunned Wall Street with a powerhouse fourth-quarter earnings report that sent its stock price soaring by more than 10% in the days following the release. As of January 30, 2026, the tech giant’s shares have reached multi-year highs, trading near the $315 mark—

Via MarketMinute · January 30, 2026

ServiceNow (NYSE: NOW) reported a powerhouse performance for its fourth quarter of 2025, beating analyst estimates across the board as its generative AI (GenAI) strategy moved from pilot programs to a significant revenue engine. On January 28, 2026, the workflow automation giant posted subscription revenue of $3.47 billion, a

Via MarketMinute · January 30, 2026

A rare moment of shortsightedness on the Oracle of Omaha's part cost Berkshire Hathaway a small fortune.

Via The Motley Fool · January 30, 2026

The global software sector experienced one of its most turbulent trading sessions in recent history on January 29, 2026, as a wave of "sympathetic" selling swept through the industry’s heavyweights. The catalyst for the downturn was a cooling sentiment toward the artificial intelligence boom, sparked by a fiscal second-quarter

Via MarketMinute · January 29, 2026

Taiwan Semiconductor recently put up stellar fourth-quarter numbers, signaling that we've yet to reach peak AI demand. Are we in for another banner year in 2026?

Via The Motley Fool · January 29, 2026

A number of stocks fell in the afternoon session after a broad sell-off in the software sector was triggered by mixed earnings from industry leaders SAP and ServiceNow.

Via StockStory · January 29, 2026

The cloud and database specialist got caught up in a broad AI sell-off.

Via The Motley Fool · January 29, 2026

Shares of CRM software giant Salesforce (NYSE:CRM) fell 7.2% in the afternoon session after negative sentiment spread across the software sector as peers including Microsoft (MSFT), SAP (SAP), and ServiceNow (NOW) provided mixed updates.

Via StockStory · January 29, 2026

AMD’s EPYC processors are gaining traction in data centers, while its Instinct GPUs are benefiting from the accelerating AI demand.

Via Barchart.com · January 29, 2026

Oracle and Workday have some encouraging growth opportunities as a result of artificial intelligence.

Via The Motley Fool · January 29, 2026

The Oracle of Omaha is familiar with the restaurant industry.

Via The Motley Fool · January 29, 2026

Oracle Corp (NASDAQ: ORCL) shares are falling Thursday due to a broader technology stock sell-off despite the company unveiling a new AI-driven analytics platform in the Life Sciences sector.

Via Benzinga · January 29, 2026

The sell-off in software stocks could be an incredible buying opportunity for long-term investors.

Via The Motley Fool · January 29, 2026

Yum China operates over 16,000 restaurants across 2,500 cities, serving a broad consumer base with a diverse brand portfolio.

Via The Motley Fool · January 29, 2026

Riot Platforms operates large-scale Bitcoin mining facilities and delivers engineered power solutions for institutional clients.

Via The Motley Fool · January 29, 2026

Software is rapidly reducing operating expenses for businesses. Companies bringing it to life have been rewarded with high valuation multiples that make fundraising easier,

but they have weighed on the returns lately as the industry has pulled back by 13.1% over the past six months. This drop is a far cry from the S&P 500’s 9.5% ascent.

Via StockStory · January 28, 2026

As the first month of 2026 draws to a close, a wave of optimism is sweeping through the equity markets, fueled by a rare alignment of fiscal stimulus, aggressive deregulation, and a structural shift in corporate productivity. Major financial institutions have revised their year-end targets for the S&P 500,

Via MarketMinute · January 28, 2026

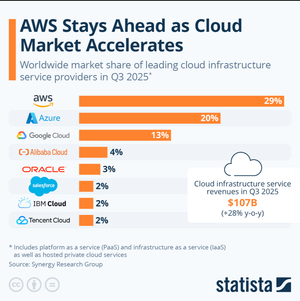

The global technology landscape is undergoing a tectonic shift as the world’s largest "hyperscalers" abandon their traditional reliance on cash reserves to embrace a historic wave of debt financing. As of late January 2026, industry giants like Amazon.com Inc. (NASDAQ: AMZN) and Alphabet Inc. (NASDAQ: GOOGL) are leading

Via MarketMinute · January 28, 2026

Global X Artificial Intelligence & Technology ETF targets firms advancing AI and big data, with a portfolio spanning global tech innovators.

Via The Motley Fool · January 28, 2026

The US credit market has entered 2026 with a level of momentum unseen in nearly a decade, as a powerful combination of multi-billion dollar mergers and a resurgence in leveraged buyouts (LBOs) drives primary issuance to record heights. Following the Federal Reserve’s pivot toward a more accommodative stance in

Via MarketMinute · January 28, 2026

A niche in high-performance computing gives Oracle a cost advantage.

Via The Motley Fool · January 28, 2026

In a move that has fundamentally rewritten the economics of the silicon age, OpenAI, SoftBank Group Corp. (TYO: 9984), and Oracle Corp. (NYSE: ORCL) have solidified their alliance under "Project Stargate"—a breathtaking $500 billion infrastructure initiative designed to build the world’s first 10-gigawatt "AI factory." As of late January 2026, the venture has transitioned from [...]

Via TokenRing AI · January 28, 2026