Latest News

The wheat complex rallied into the long weekend with gains across the three markets. Chicago SRW futures were 7 to 8 cents higher on Friday, with March up just ¾ cent from last week. KC HRW futures saw Friday gains of 9 to 10 cents in the nearbys, wi...

Via Barchart.com · January 16, 2026

Plenty of results are still to come. But at this early stage, the revenue beats percentage is tracking below the historical average, with all the other metrics in the historical range.

Via Talk Markets · January 16, 2026

Cameco and Duke Energy both make a compelling case for a nuclear energy investment, but one of them is a much better dividend play.

Via The Motley Fool · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

Via MarketBeat · January 16, 2026

These two AI stocks look like strong long-term compounders.

Via Barchart.com · January 16, 2026

AI-fueled server demand, surging trading volume, and sector momentum put this hardware maker in sharp focus, today, Jan. 16, 2026.

Via The Motley Fool · January 16, 2026

As of mid-January 2026, the global financial markets are witnessing a profound structural rotation. For three years, Artificial Intelligence (AI) has been the undisputed engine of market growth, propelling indices to record highs. However, with "AI fatigue" setting in and the physical limits of silicon-based hardware becoming an inescapable bottleneck

Via MarketMinute · January 16, 2026

AMD is down by more than 20% from all-time highs, which presents a good opportunity to buy the dip.

Via The Motley Fool · January 16, 2026

As the world’s financial elite gather for the annual World Economic Forum in Davos, a stark divergence has emerged in the global executive psyche. While much of the world is cautiously eyeing a recovery from years of inflationary pressure, a flurry of mid-January 2026 surveys reveals that United States

Via MarketMinute · January 16, 2026

As of mid-January 2026, the global payment landscape is caught in a profound contradiction. While industry giants Visa (NYSE: V) and Mastercard (NYSE: MA) continue to report record-breaking revenues and double-digit earnings growth, their market valuations are being haunted by a spectral array of regulatory and political threats. The "duopoly"

Via MarketMinute · January 16, 2026

Via Benzinga · January 16, 2026

In a striking display of the "beat-and-drop" phenomenon, State Street Corporation (NYSE: STT) reported fourth-quarter 2025 results on January 16, 2026, that highlighted a growing tension in the custody banking sector. Despite hitting record revenue of $3.67 billion—a 7.5% year-over-year increase—and reaching an all-time high of

Via MarketMinute · January 16, 2026

In a landmark decision for the U.S. renewable energy sector, a federal court has granted a preliminary injunction allowing Dominion Energy (NYSE: D) to immediately resume construction on the Coastal Virginia Offshore Wind (CVOW) project. The ruling, handed down today, January 16, 2026, effectively lifts a controversial stop-work order

Via MarketMinute · January 16, 2026

WASHINGTON D.C. — In a dramatic escalation of his "America First" foreign policy, President Donald Trump has moved beyond mere interest to a formal demand for the acquisition of Greenland, threatening a wave of crippling tariffs against any nation—including long-standing NATO allies—that opposes the bid. As of January

Via MarketMinute · January 16, 2026

As of January 16, 2026, the global technology sector is witnessing a historic pivot, led by a massive valuation surge in the memory chip market. Micron Technology (NASDAQ: MU) has seen its stock price skyrocket in the opening weeks of the year, reaching an all-time high of $355.44. This

Via MarketMinute · January 16, 2026

As of January 16, 2026, the global energy landscape is grappling with a sudden and violent shift. Following the dramatic geopolitical events of early January—most notably the "Venezuela Shock" and escalating unrest in Iran—Brent crude prices have recently surged to an intraday peak of over $75 per barrel.

Via MarketMinute · January 16, 2026

As of mid-January 2026, the global financial landscape is witnessing a tectonic shift in how the world’s largest technology companies manage their balance sheets. For over a decade, the "Big Three" of cloud computing—Amazon.com, Inc. (NASDAQ:AMZN), Alphabet Inc. (NASDAQ:GOOGL), and Microsoft Corporation (NASDAQ:MSFT)—were

Via MarketMinute · January 16, 2026

The high-flying momentum of the artificial intelligence sector met a cold reality in the opening weeks of 2026 as Palantir Technologies Inc. (NYSE: PLTR) saw its stock price tumble by more than 11%. This sudden retreat follows a historic "monster" year in 2025, where the data analytics giant surged by

Via MarketMinute · January 16, 2026

Broadcom is primed to deliver explosive growth this year.

Via The Motley Fool · January 16, 2026

As the global financial markets navigate the opening weeks of 2026, the spotlight has once again intensified on Veldhoven, Netherlands. ASML Holding N.V. (NASDAQ: ASML), the world’s sole provider of the extreme ultraviolet (EUV) lithography machines required to print the world’s most advanced microchips, has solidified its

Via MarketMinute · January 16, 2026

Explosive Anktiva sales, new cancer data, and fresh approvals are rapidly redefining this immunotherapy story, today, Jan. 16, 2026.

Via The Motley Fool · January 16, 2026

The century-long tradition of Federal Reserve independence is facing its gravest threat to date as the Department of Justice (DOJ) has launched an unprecedented criminal investigation into Fed Chair Jerome Powell. The news, which broke on January 11, 2026, has sent shockwaves through global financial markets, raising fears that the

Via MarketMinute · January 16, 2026

Via Benzinga · January 16, 2026

In a move that signals a seismic shift for Wall Street’s most storied investment bank, Goldman Sachs (NYSE: GS) CEO David Solomon has officially signaled the firm’s intent to enter the rapidly maturing world of prediction markets. Speaking during the company’s Q4 2025 earnings call on January

Via MarketMinute · January 16, 2026

In a move that signals the definitive end of the "wild west" era of free, ad-free generative AI, OpenAI officially announced on January 16, 2026, that it will begin rolling out advertisements to ChatGPT for its US-based users. This pivot, which includes the launch of a new "ChatGPT Go" tier,

Via MarketMinute · January 16, 2026

In a move that has provided temporary breathing room for the world’s most valuable automaker, the National Highway Traffic Safety Administration (NHTSA) granted Tesla (NASDAQ: TSLA) a five-week extension on Friday, January 16, 2026. The reprieve concerns a high-stakes federal investigation into potential traffic-law violations by the company’s

Via MarketMinute · January 16, 2026

As the calendar turns toward late January 2026, a high-stakes standoff between the White House and the nation’s largest financial institutions has reached a breaking point. President Donald Trump has renewed his call for a mandatory 10% cap on credit card interest rates, setting a self-imposed deadline of January

Via MarketMinute · January 16, 2026

As the Federal Reserve grapples with a complex economic landscape in early 2026, Governor Michelle Bowman has delivered a striking shift in rhetoric, signaling that the central bank’s work in lowering interest rates is far from over. Speaking at the Outlook '26: The New England Economic Forum on January

Via MarketMinute · January 16, 2026

H.C. Wainwright double upgraded Iren to ‘Buy’ from ‘Sell’ with a price target of $80, up from $56.

Via Stocktwits · January 16, 2026

In a week defined by dramatic market divergence, the U.S. stock market has undergone one of its most significant structural shifts in years. As of January 16, 2026, a massive migration of capital is underway, moving from the high-flying technology giants that dominated the previous three years into "old

Via MarketMinute · January 16, 2026

New data shows that SMCI is the No. 3 most shorted stock by hedge funds. Here's what else to know about Super Micro Computer.

Via Barchart.com · January 16, 2026

Some AI-focused companies are not worth the trouble.

Via The Motley Fool · January 16, 2026

As the final tallies from the fourth-quarter earnings season roll in this January 2026, the verdict is clear: Wall Street’s titans have not just survived a period of economic uncertainty—they have thrived. Defying fears of a persistent slowdown, the largest U.S. financial institutions reported record-breaking annual revenues

Via MarketMinute · January 16, 2026

As of January 16, 2026, the global technology landscape has received a definitive signal that the artificial intelligence revolution is not only enduring but accelerating. Taiwan Semiconductor Manufacturing Company (NYSE:TSM) released its fourth-quarter 2025 financial results yesterday, shattering all previous records and single-handedly lifting market sentiment across the Pacific.

Via MarketMinute · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

Get insights into the top gainers and losers of Friday's after-hours session.chartmill.com

Via Chartmill · January 16, 2026

U.S. President Donald Trump has previously said that he was looking to introduce a one-year 10% cap on credit card interest rates after pointing out that the current rates were exorbitantly high.

Via Stocktwits · January 16, 2026

The market appeared to view the financing as strategic rather than defensive, given Broadcom’s strong cash generation and profitability profile.

Via Talk Markets · January 16, 2026

For investors looking to generate growth on $1,000, it could pay to look beyond the U.S.

Via The Motley Fool · January 16, 2026

Intel shares have soared heading into the firm’s earnings release on Jan. 22. But a Citi analyst and options traders believe INTC stock will push higher from here in 2026.

Via Barchart.com · January 16, 2026

Via Benzinga · January 16, 2026

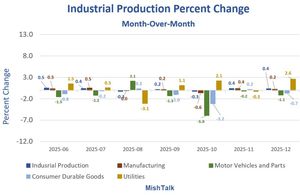

AI Boom. Utilities provided 88.8% of the increase in IP this month.

Via Talk Markets · January 16, 2026